The operating system for profitable growth

Payrails transforms fragmented financial workflows through one modular and connected platform.

By providing your team with expanded intelligence, freedom and control over your financial stack, we help global businesses to maximize revenue, lower costs, and grow at the pace of ambition.

Payments at our core - and yours

Payments power every business. Yet when it comes to getting paid, merchants face a patchwork of platforms, providers and disconnected financial operations. Payrails puts your company back in control.

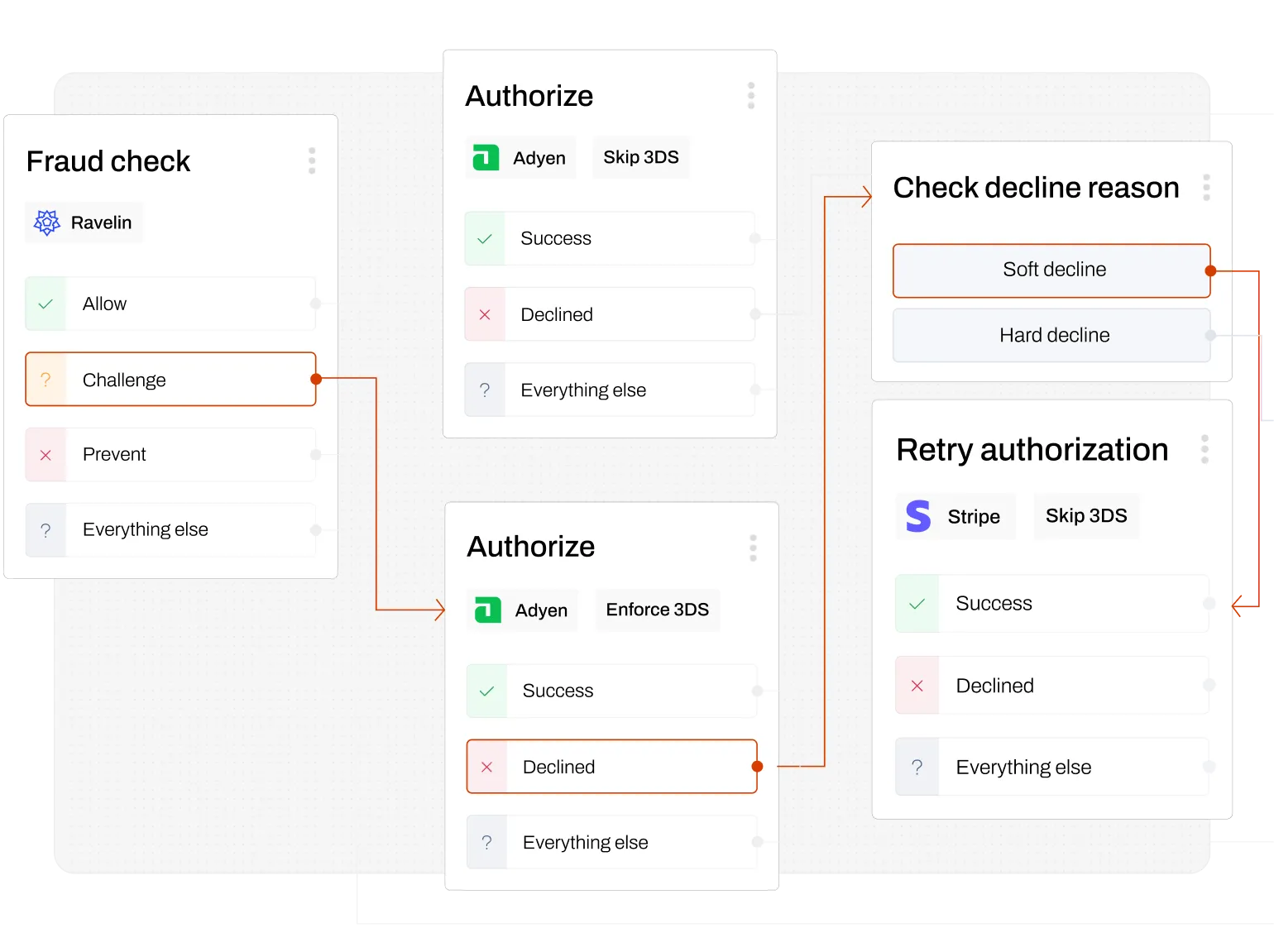

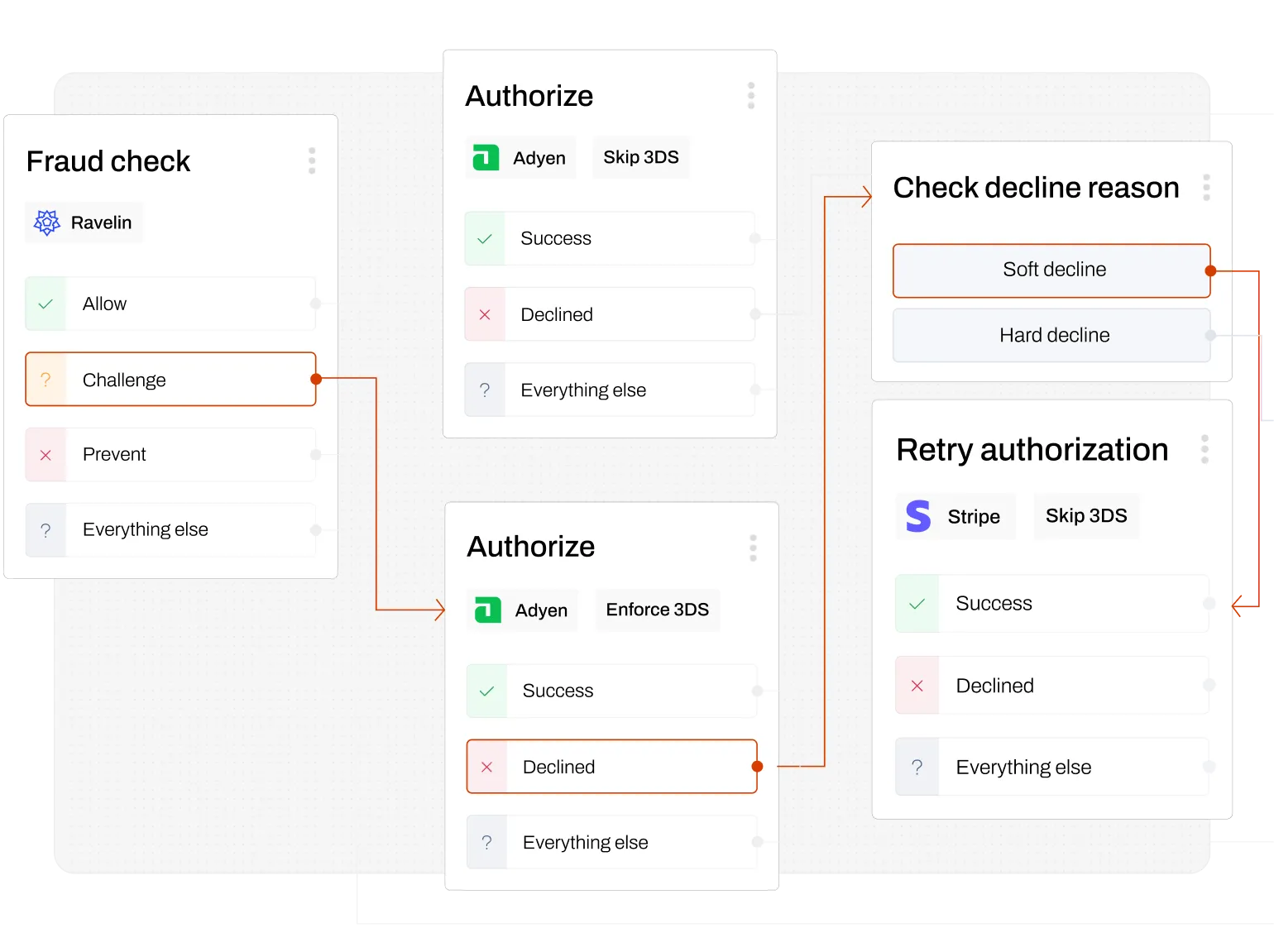

Operate with full visibility and automated workflows

Replace fragmented payment logic with one integration

Gain clearer insights into performance and margins

Unlock the freedom to choose and optimize providers

Your balance sheet’s best friend

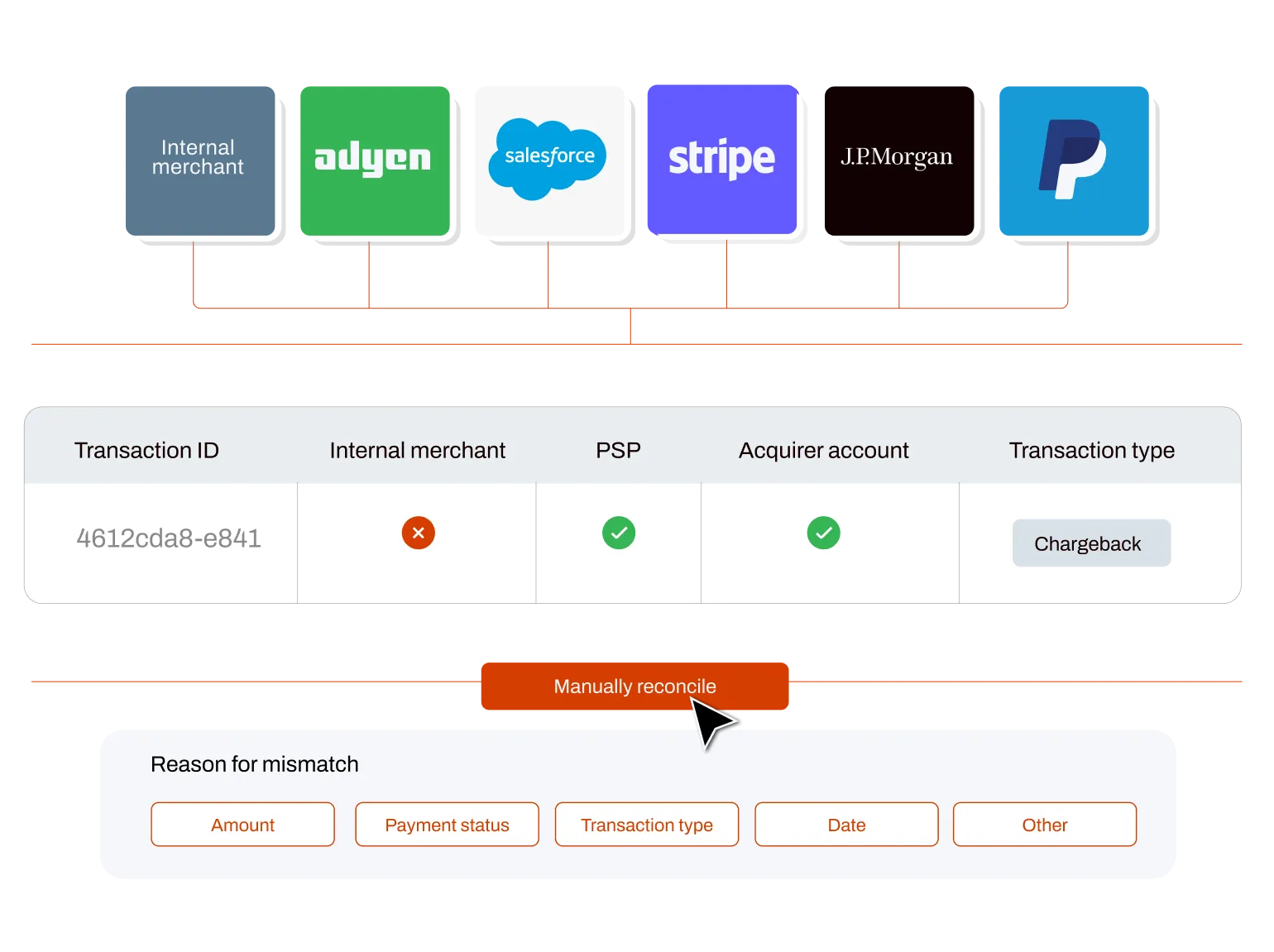

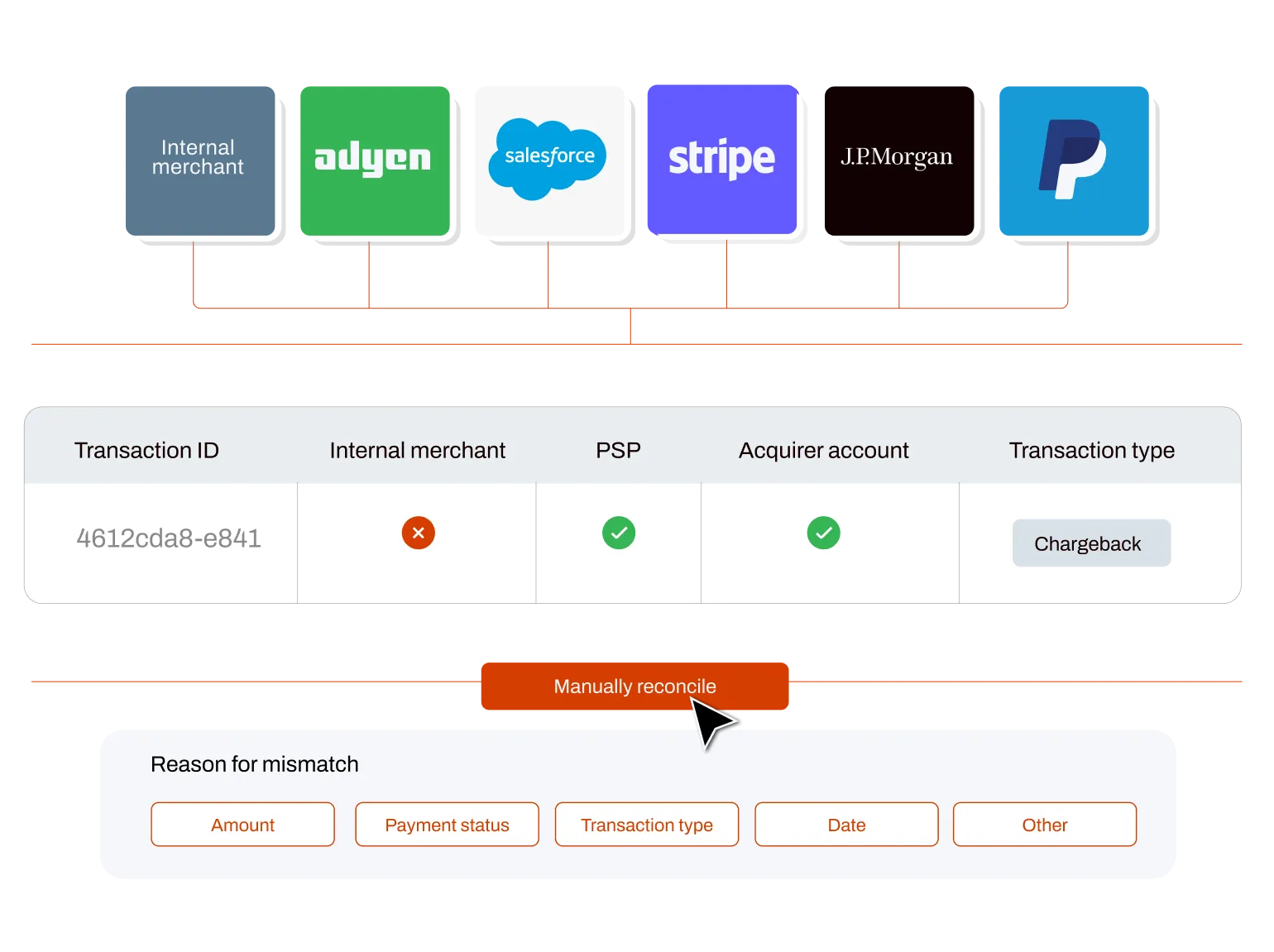

Manual reconciliation and inconsistent reporting make it harder to close the books – and harder to scale. Payrails turns your payment lifecycle from a bottleneck into a strategic advantage.

Replace 95% of manual work with automated reconciliation

Standardize execution to support profitable growth

Scale the business without financial drag

Make better-informed, more confident decisions

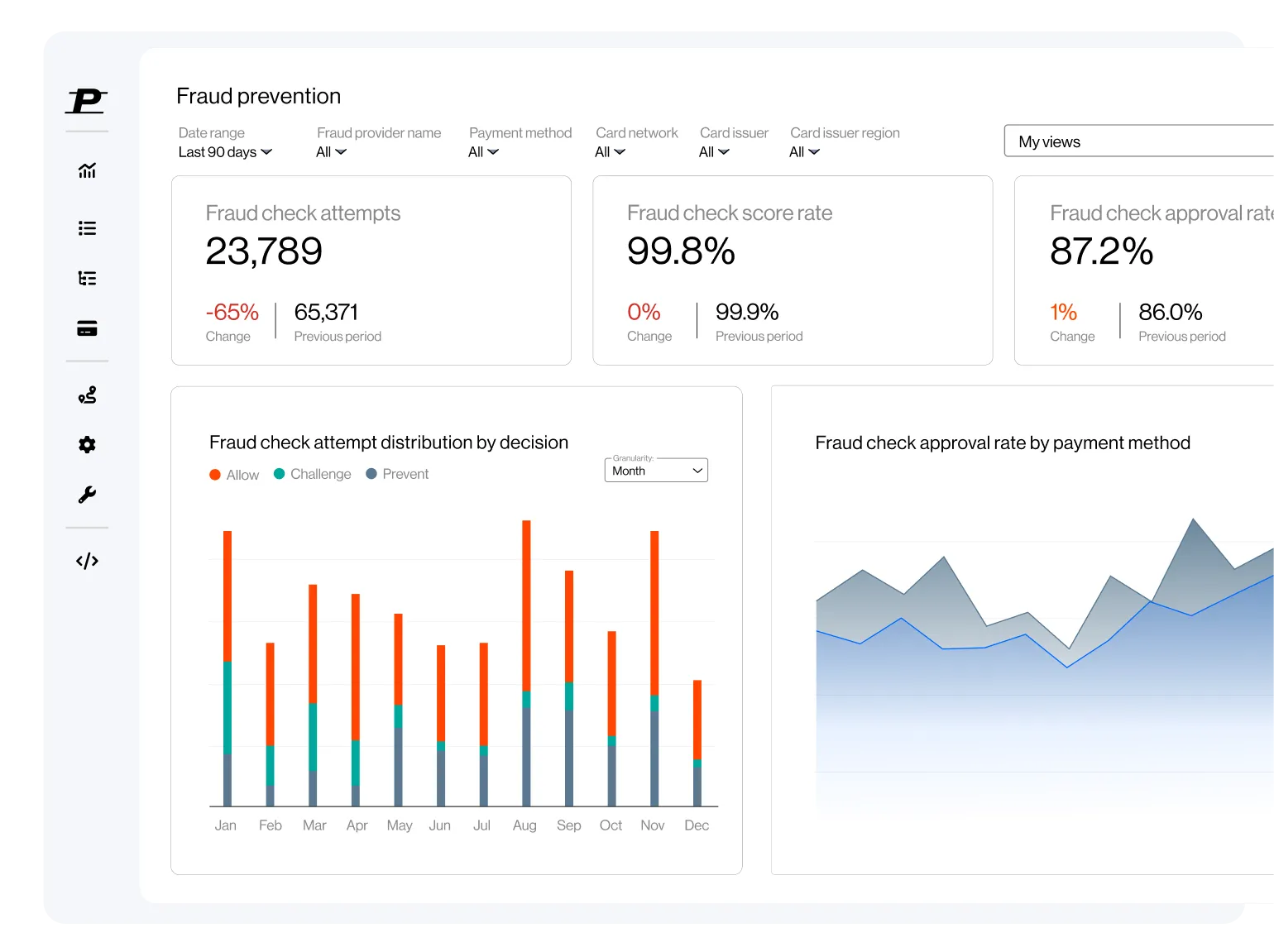

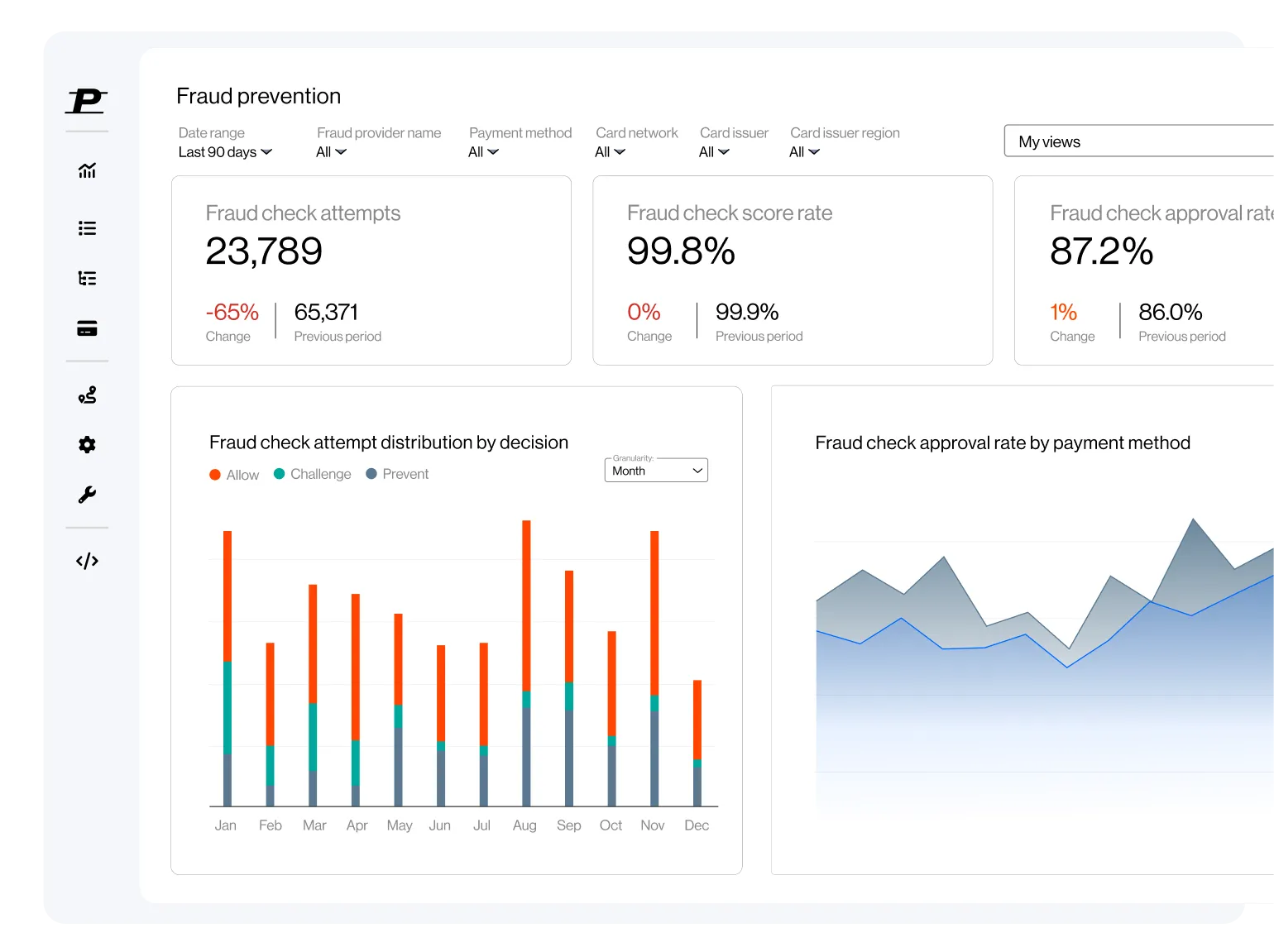

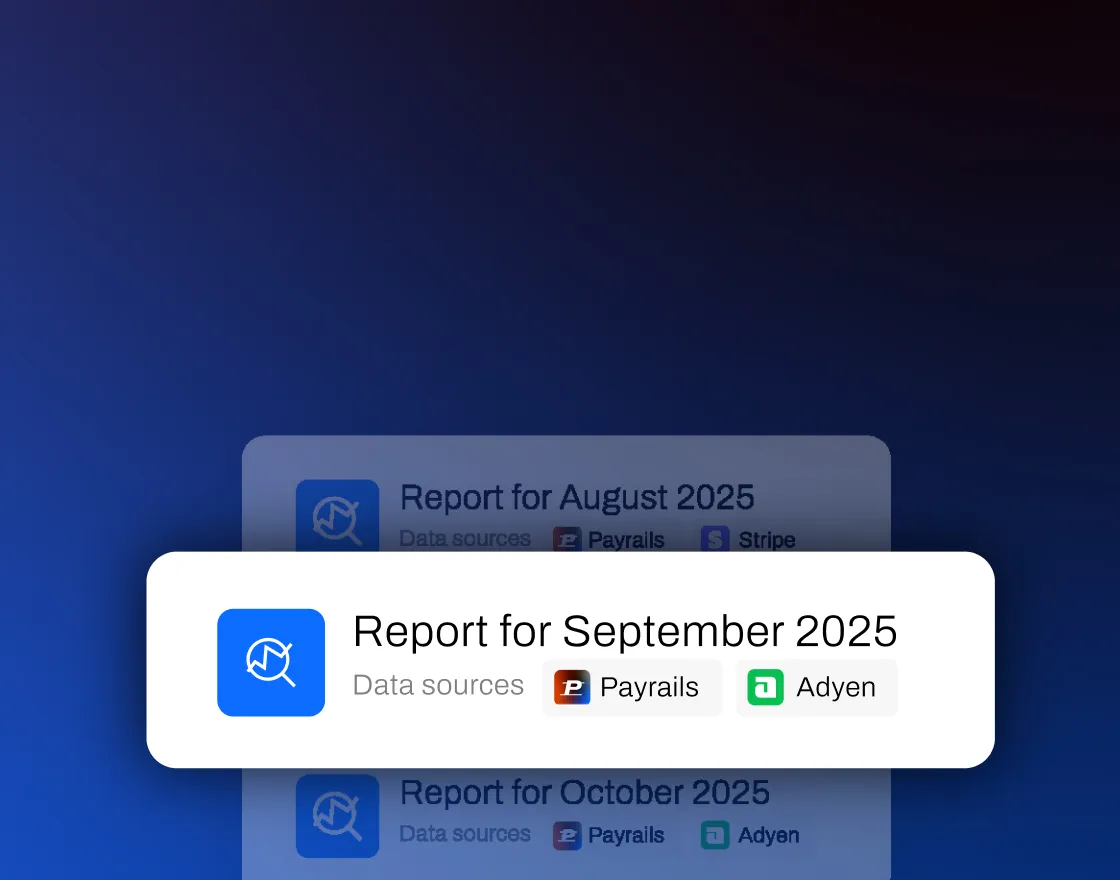

Data that works across your business

For most merchants, transaction data is spread across providers, tools, and teams – making it difficult to trust or act on. With a unified foundation, Payrails helps teams transform data into intelligence.

Optimize costs and approvals based on a single source of truth

Turn transaction data into decision-ready insight

Connect payments to conversion and customer behavior

Build operating leverage through data-powered optimization

Grow on your terms

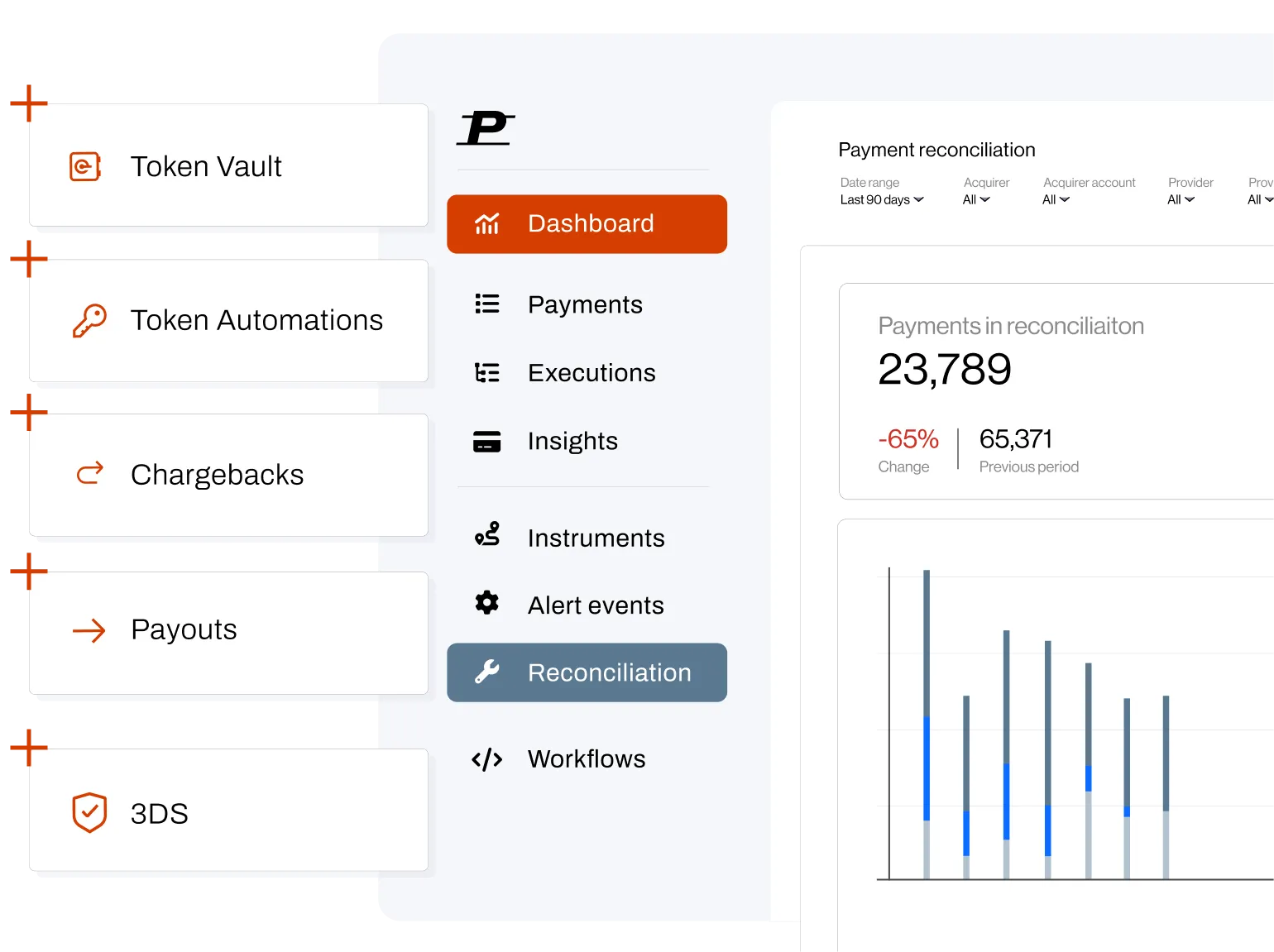

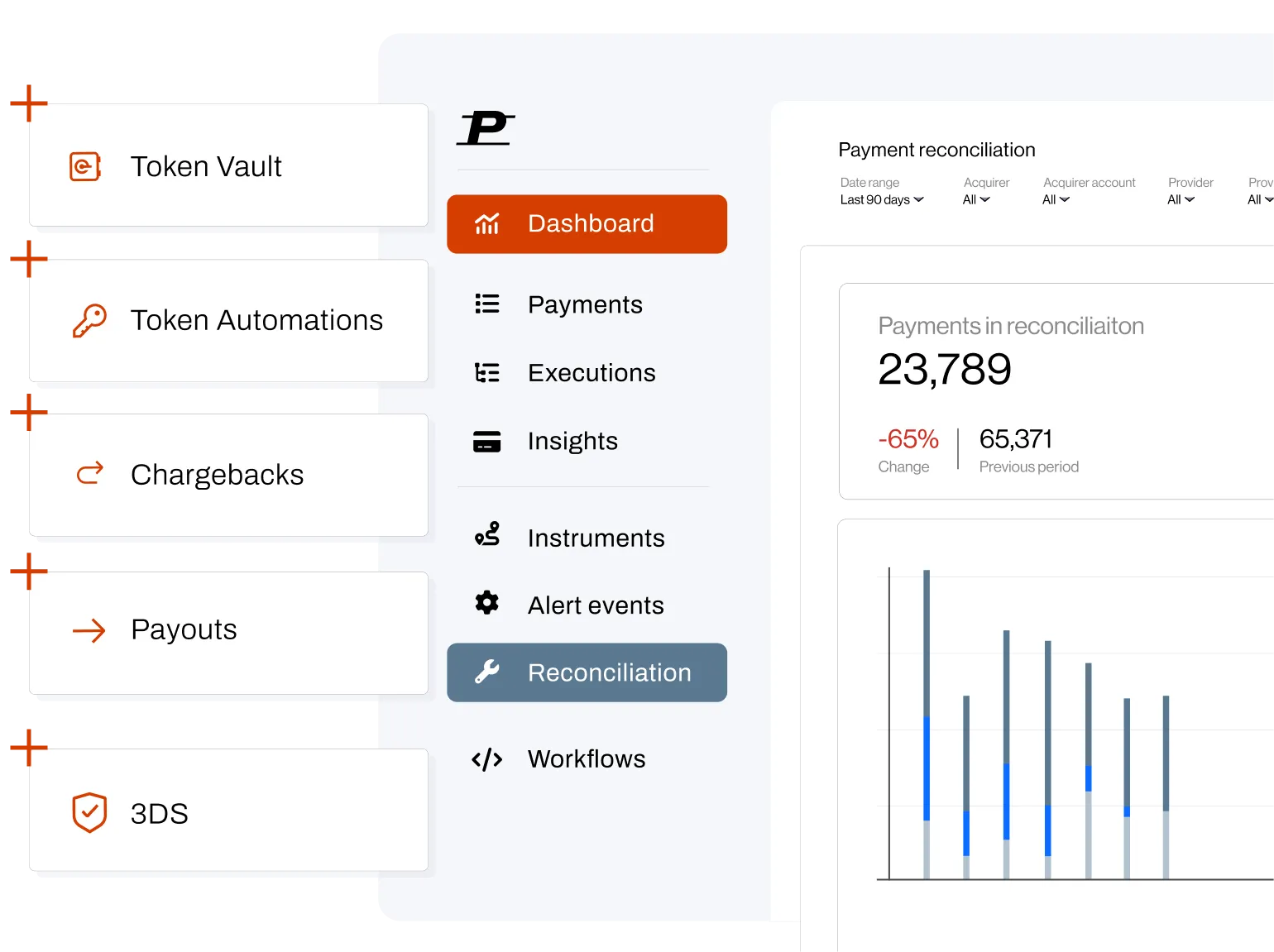

With a modular, provider-agnostic approach that allows teams to integrate individual products at any scale and combination, Payrails gives your company the freedom to build financial infrastructure that works with your business – not against it.

Beginning with payments, taking you wherever you want to go.

Payments power every business. Yet when it comes to getting paid, merchants face a patchwork of platforms, providers and disconnected financial operations. Payrails puts your company back in control.

Operate with full visibility and automated workflows

Replace fragmented payment logic with one integration

Gain clearer insights into performance and margins

Unlock the freedom to choose and optimize providers

Manual reconciliation and inconsistent reporting make it harder to close the books – and harder to scale. Payrails turns your payment lifecycle from a bottleneck into a strategic advantage.

Replace 95% of manual work with automated reconciliation

Standardize execution to support profitable growth

Scale the business without financial drag

Make better-informed, more confident decisions

For most merchants, transaction data is spread across providers, tools, and teams – making it difficult to trust or act on. With a unified foundation, Payrails helps teams transform data into intelligence.

Optimize costs and approvals based on a single source of truth

Turn transaction data into decision-ready insight

Connect payments to conversion and customer behavior

Build operating leverage through data-powered optimization

With a modular, provider-agnostic approach that allows teams to integrate individual products at any scale and combination, Payrails gives your company the freedom to build financial infrastructure that works with your business – not against it.

Beginning with payments, taking you wherever you want to go.

With payments at the core. Transform financial operations into a competitive edge.

Your business isn’t one-size-fits-all. Your infrastructure shouldn't be either.

With payments at the core. Transform financial operations into a competitive edge.

What’s in the operating system?

Add capability, not complexity.

Platform

Build and adapt payment operations with configurable workflows, modular components, and ready-made integrations.

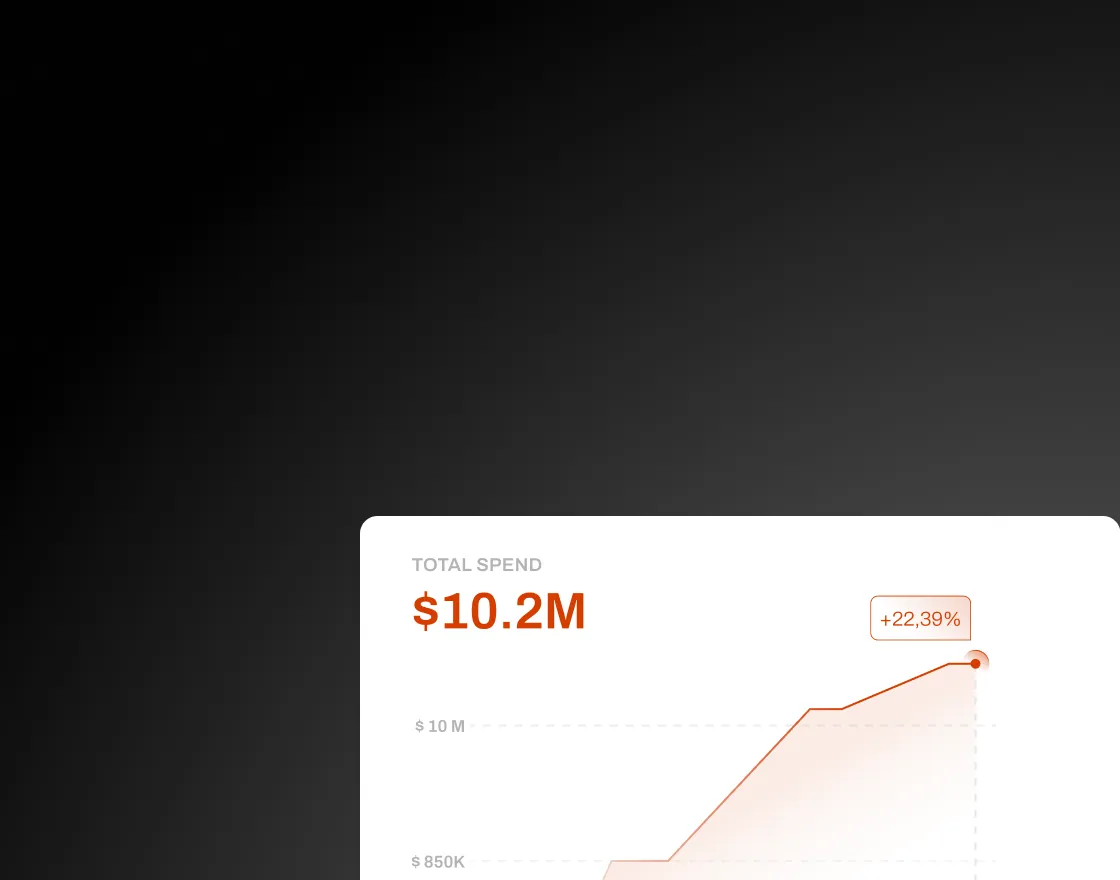

Unified Analytics

Real-time visibility across PSPs and payment metrics.

Insights for CFOs, payment leads, and financial ops – all in one view.

Payment orchestration

Grow approval rates and reduce payment costs in one PSP-agnostic layer.

More efficient payments mean more time and money to grow your business.

Token Vault & Proxy

Merchant-led tokenization with PCI DSS compliance.

Own your credentials, reduce risk, and regain control.

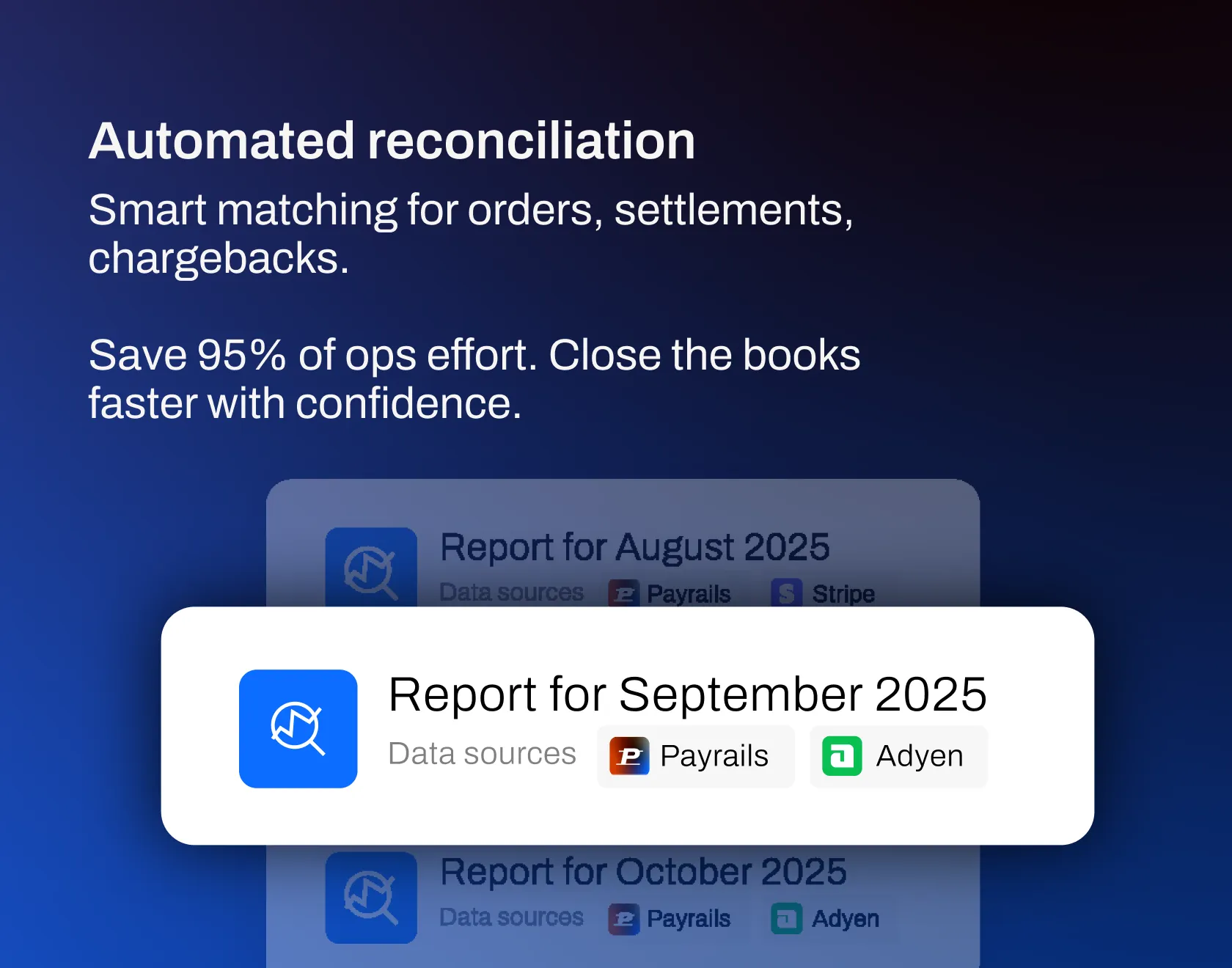

Automated reconciliation

Smart matching for orders, settlements, chargebacks.

Save 95% of ops effort. Close the books faster with confidence.

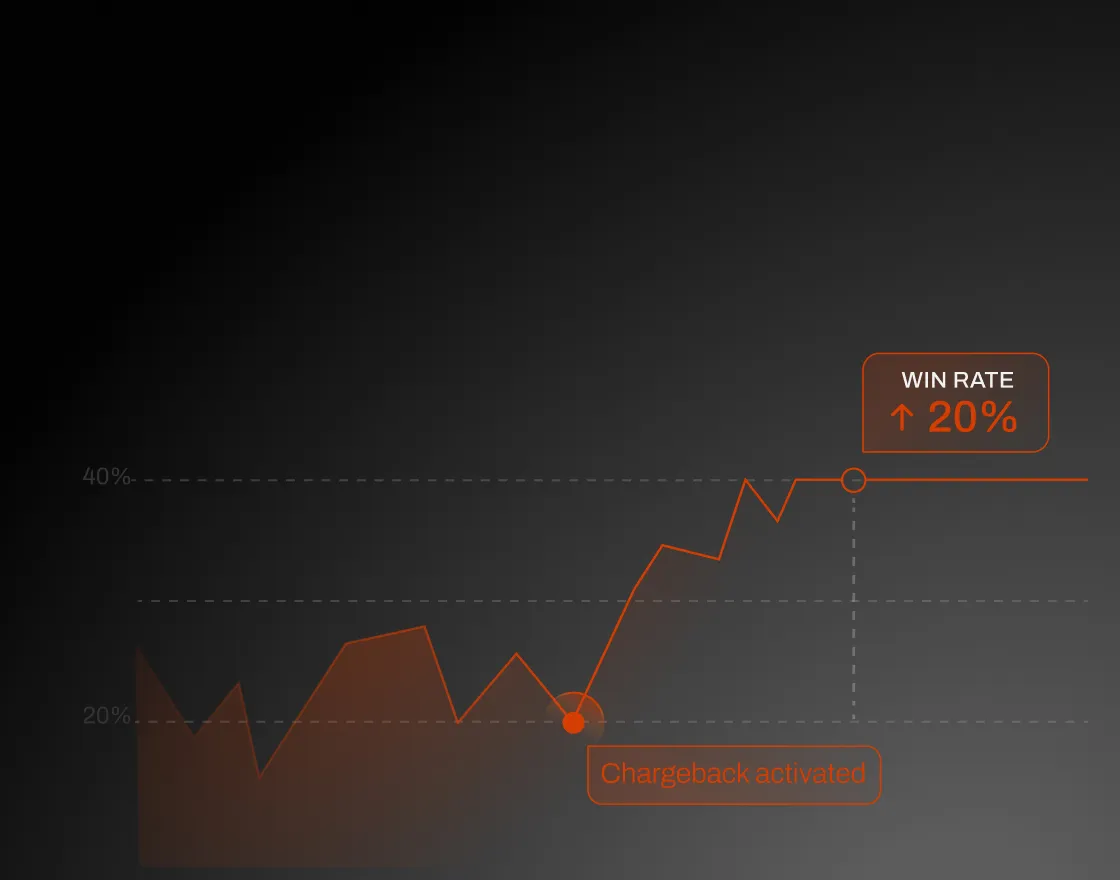

Chargeback Management

End-to-end control over disputes, from alerts to resolution.

Cut time, reduce losses, and protect revenue at scale.

Add capability, not complexity.

Built for your team. So you can build for the future.

Margin visibility, smarter reconciliation, audit readiness

Better success rates, PSP flexibility

Fewer integrations, faster launches

Scalable automation, less manual effort

Tokenization, audit trails, reduced risk

The world we’re

building, together

.svg)

1. Flexible by nature

2. Control stays with you

3. See the full picture

4. An extension of your team

building, together

Flexible by nature

No monoliths, no overhauls. Start with what you need and plug in key capabilities as your business evolves.

Control stays with you

Own your tokens, routing, and configuration. Stay compliant, flexible, and scale on your terms.

See the full picture

Make better decisions with unified data and performance analytics.

An extension of your team

Combining technical excellence with enterprise experience, our experts help you transform payments from a cost center to an engine for growth.

Trusted by global brands. Proven in high-scale environments.

Head of Payments at Eneba

“We had tried other solutions, but they couldn’t adapt to the complexities of our payments flow or deliver consistent performance improvements. Payrails’ modular infrastructure and proactive, hands-on approach made them an effective partner in achieving these results.”

“We chose Payrails because they felt like an extension of our team, not just another vendor. They’ve worked closely with us, offering thoughtful recommendations and collaborating on solutions. Together we expanded our integrations, decreased checkout churn, and streamlined our payment data analysis.”

Senior Product Manager at Preply

.webp)

“Our partnership with Payrails has had an observable influence on our business. The 11% increase in card payment approval rates has had a positive impact on our revenue. Along every step of the collaboration, the Payrails team has demonstrated professionalism and a strong commitment to achieving outcomes.”

Head of Fintech at inDrive

“We had tried other solutions, but they couldn’t adapt to the complexities of our payments flow or deliver consistent performance improvements. Payrails’ modular infrastructure and proactive, hands-on approach made them an effective partner in achieving these results.”

Head of Payments at Eneba

.webp)

“We chose Payrails because they felt like an extension of our team, not just another vendor. They’ve worked closely with us, offering thoughtful recommendations and collaborating on solutions. Together we expanded our integrations, decreased checkout churn, and streamlined our payment data analysis.”

Senior Product Manager at Preply

“Our partnership with Payrails has had an observable influence on our business. The 11% increase in card payment approval rates has had a positive impact on our revenue. Along every step of the collaboration, the Payrails team has demonstrated professionalism and a strong commitment to achieving outcomes.”

Head of Fintech at inDrive