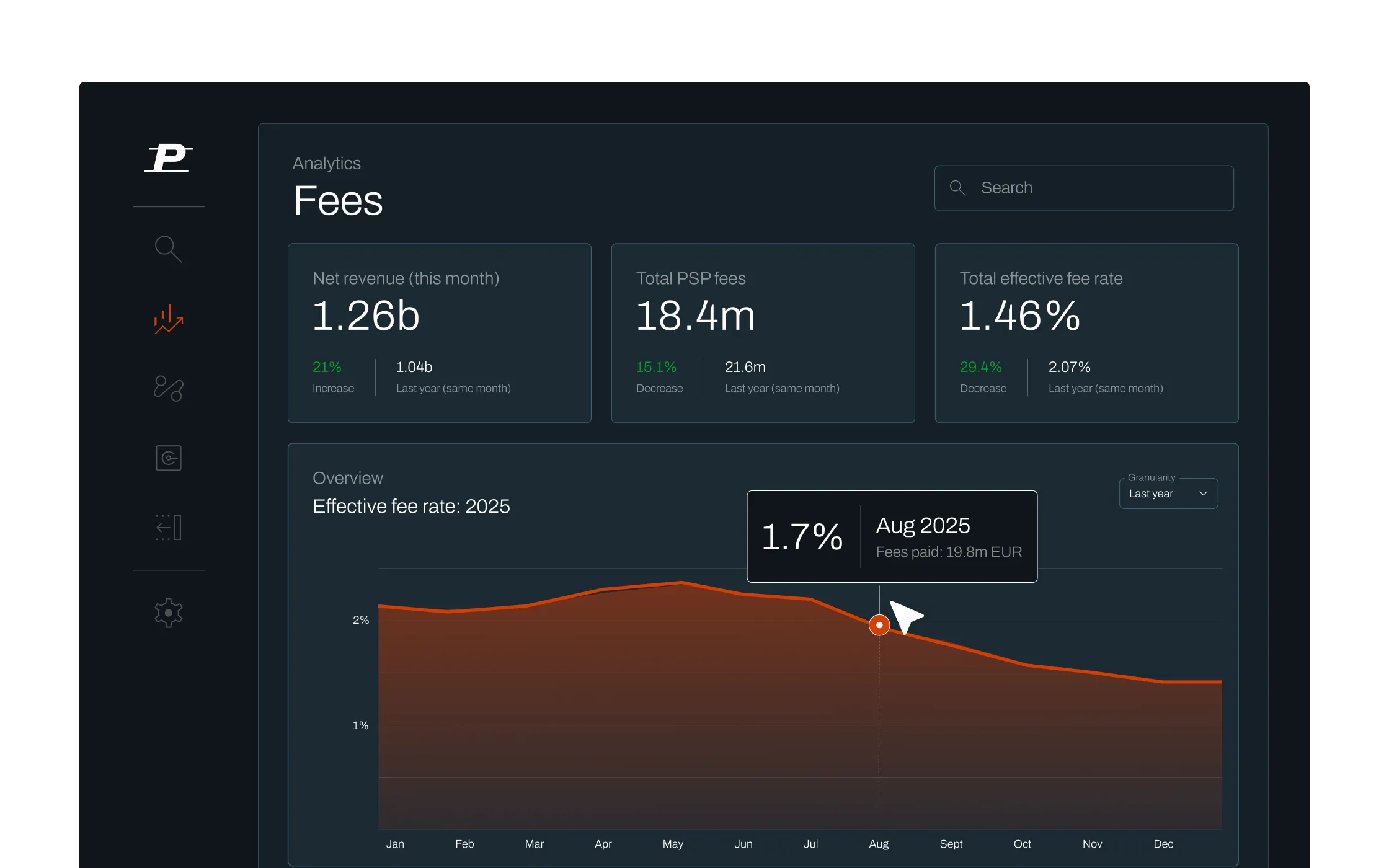

Fee Monitoring: Find hidden payment overcharges

Unify settlement data across PSPs, audit interchange fees, and uncover fee leakage. Request a cost optimization analysis and see where you could be saving money.

Payment fees are eating into your profit margins

For high‑volume merchants, payment fees can be a top operating expense. Yet most finance teams still have to trust provider reports that are difficult and time-consuming to reconcile.

A black box of payment costs

Discrepancies and limited transparency make it nearly impossible to verify payment processing fees across providers.

The manual settlement gap

Granular discrepancies in fees and conversions lead to significant time lost each month reconciling inconsistent data.

Overcharges hide in complexity

Pass‑through fees and markups are difficult to audit consistently.

Your independent payments auditor

Payrails Fee Monitoring is a provider‑agnostic auditing and analytics layer that unifies settlement data across PSPs and translates cryptic fee line items into a clear, finance‑ready breakdown.

A standalone,

no-code auditing engine

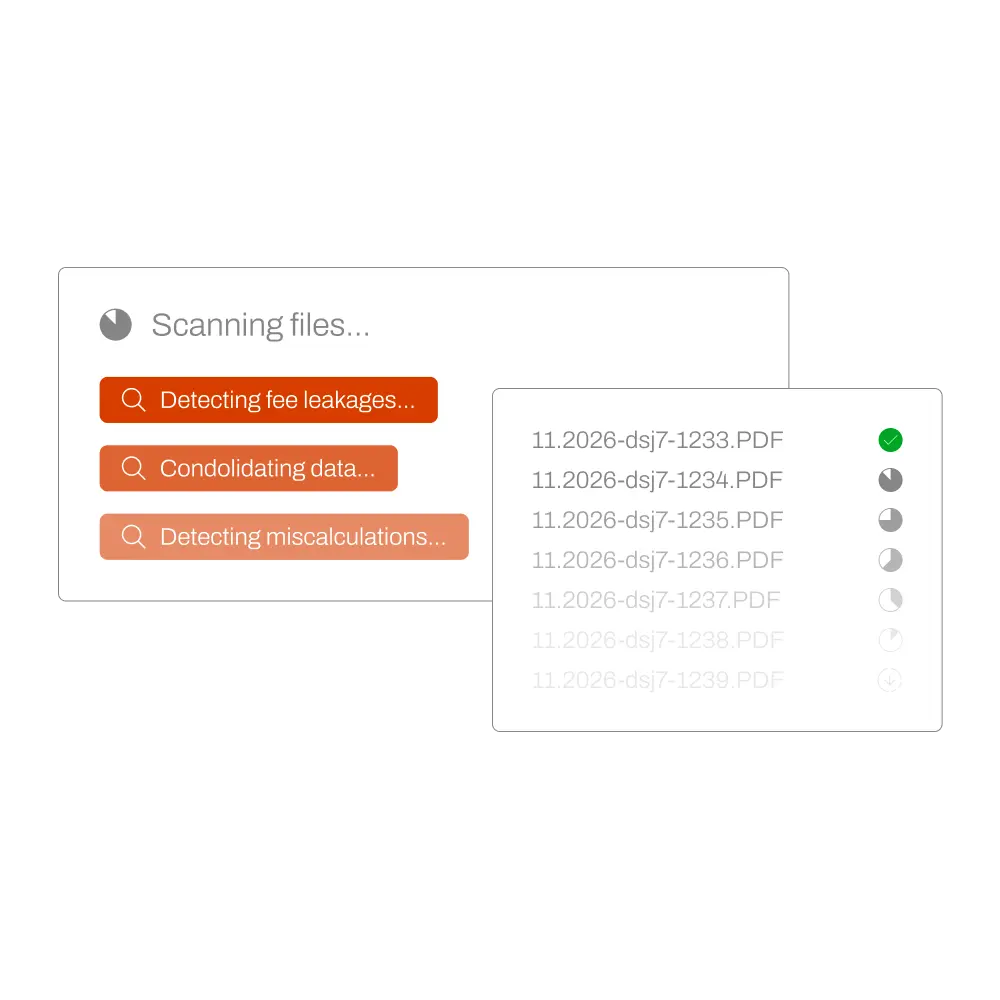

- Normalize fragmented settlement data into a single schema

- Translate processor codes into plain‑language cost items

- Audit contract compliance (markups and pass‑through costs)

- Detect fee leakage and miscalculations

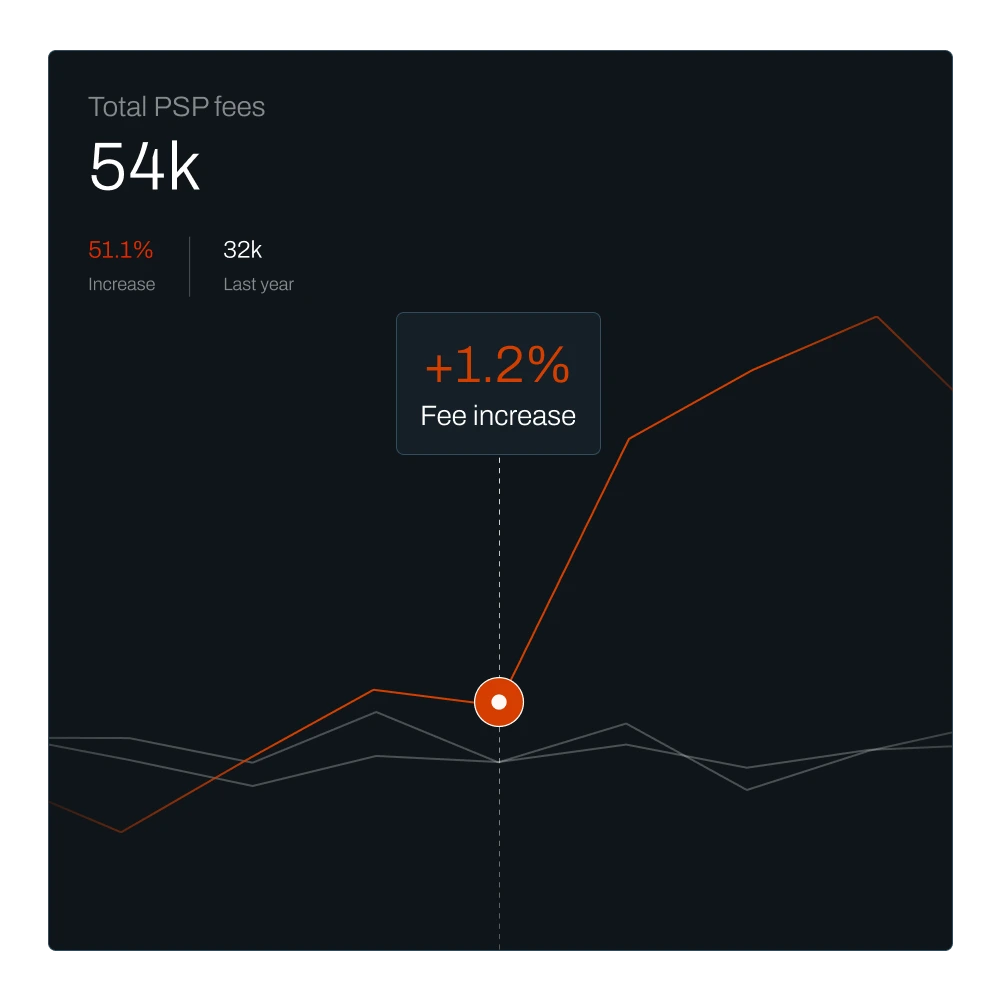

- Benchmark effective rates across PSPs, payment methods, regions, and entities

Find out where you could be saving money

What we do

- Ingest your settlement file(s) and transaction report for the same period

- Map and normalize all fees into a single, human‑readable view

- Identify leakage and fee anomalies across PSPs and payment methods

- Check compliance against your contract structure (if provided)

- Deliver a savings report with estimated impact and next steps

What you get back

- Normalize fragmented settlement data into a single schema

- Translate processor codes into plain‑language cost items

- Audit contract compliance (markups and pass‑through costs)

- Detect fee leakage and miscalculations

- Benchmark effective rates across PSPs, payment methods, regions, and entities

Who is fee monitoring for?

Payrails Fee Monitoring is made for payments and finance teams that want to optimize cash flow, reduce revenue leakage, save time, and improve the bottom line.

If your organization meets one or more of the following criteria, fee monitoring is for you

- High transaction volume (€50M+ GMV)

- Multiple PSPs

- Interchange‑plus pricing structures that are difficult to audit at scale

- Industries like travel, high‑volume e‑commerce, marketplaces, global SaaS, and on‑demand services

Built for the entire finance org

- CFO / VP Finance: Margin protection, auditability, negotiation leverage

- Controller / Treasury: Faster reconciliation, fewer month‑end surprises

- Head of Payments: Normalized cost insights across a multi‑PSP stack

Stop leaking revenue, start optimizing costs

Send a settlement file and transaction report, and we’ll identify where you could be saving money.